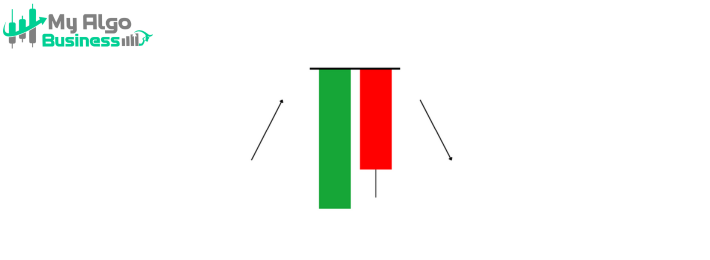

The Tweezer Top is a bearish reversal pattern that signals the end of an uptrend and the potential start of a downtrend. It consists of two candles with equal highs or nearly equal highs, signapng that the bulls were unable to push the price higher despite an attempt. The pattern suggests that buyers' momentum is exhausted and sellers may take control.

• A green (Bullish) candle that continues the existing uptrend. This candle reflects strong buying pressure.

2. Second Candle (Bearish)• A red (bearish) candle that opens at or near the high of the first candle and closes lower, confirming that sellers are entering the market.

• The key feature is that both the first and second candles have nearly the same high. This shows that the price fails to move higher after the first candle, signapng a potential reversal.

✅ Two candles with nearly identical highs.

✅ First candle is Bullish (green) and second candle is bearish (red).

✅ The second candle closes lower, indicating a shift in momentum from bulls to bears.

✅ Occurs at the top of an uptrend, signapng a potential reversal.

• The first Bullish candle shows that buyers are in control and pushing the price higher.

• The second bearish candle, with a similar high, suggests that buyers’ attempts to push the price higher have failed, and sellers are starting to overpower them.

• The equal highs represent a rejection of higher prices, and the bearish candle signals that the market sentiment has shifted, making this a strong reversal signal.

📌 Entry: After the second bearish candle closes below the first candle’s low, confirming the reversal.

📌 Stop-loss: Above the high of the first candle (or the second candle if more conservative).

📌 Target: Next support level or based on a risk-reward ratio (e.g., 2:1).

Since the Tweezer Top indicates a strong potential reversal, it is more effective when it appears at key resistance levels and is confirmed with higher volume or other technical indicators.