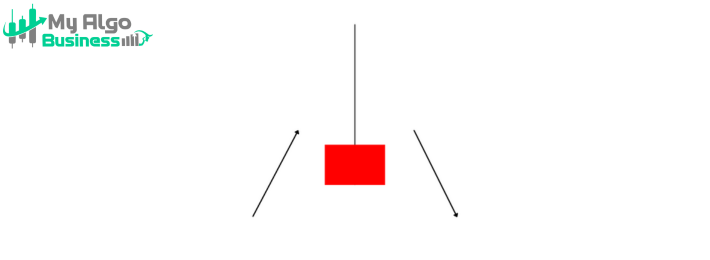

The Shooting Star is a bearish reversal pattern that forms after an uptrend, signaling that the price could reverse and start moving lower. This pattern is visually characterized by a small body at the bottom of the candle with a long upper shadow (wick), indicating that buyers initially pushed the price higher, but by the close of the session, sellers took control, pushing the price back down.

• The body of the candle is small and located near the bottom of the candle. The body can be bullish (green) or bearish (red), but the color isn’t as important as the position of the body in relation to the wick.

2. Long Upper Shadow• The candle has a long upper shadow, at least twice the length of the body. This upper wick shows that buyers tried to push the price higher, but the sellers managed to pull the price back down by the close.

3. No or Short Lower Shadow• The lower shadow is typically very short or nonexistent, indicating that there was minimal downward pressure during the session.

4. Occurs after an uptrend• The Shooting Star appears at the top of an uptrend, suggesting a potential trend reversal to the downside.

✅ Small body at the bottom of the candle, with a long upper shadow.

✅ Upper shadow should be at least twice the length of the body.

✅ Little to no lower shadow.

✅ Occurs after a strong uptrend, signaling a potential reversal from bullish to bearish.

✅ Indicates that buyers initially dominated, but sellers took over, pushing the price down.

• The long upper shadow represents the initial buying pressure, where the price was pushed higher during the session.

• The fact that the price closed near its opening price (or lower) shows that sellers eventually overpowered the buyers and pushed the price back down, creating a bearish sentiment.

• The small body near the bottom of the candle signifies that buying pressure is exhausted, and the market may now be preparing to reverse lower.

• The Shooting Star is a warning that the uptrend may be losing steam, and a bearish reversal could be imminent, especially if confirmed by subsequent candles.

📌 Entry: After the Shooting Star candle closes, traders typically wait for the next candle to confirm the reversal by closing below the low of the Shooting Star candle.

📌 Stop-loss: Place above the high of the Shooting Star candle (or above the high of the next candle if more conservative).

📌 Target: Next support level or based on a risk-reward ratio (e.g., 1:2).

The Shooting Star is most effective when it forms at key resistance levels and is confirmed by a strong bearish candle after it. It is a reversal pattern that suggests sellers are beginning to take control after an uptrend.