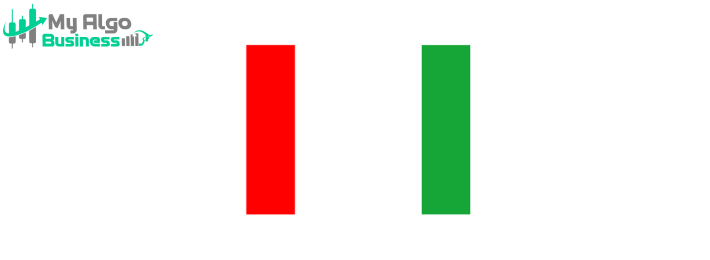

The Marubozu is a strong and decisive candlestick pattern that signifies significant momentum in one direction. It is a candlestick with no wicks or shadows (or very minimal shadows) and a large body, indicating that the opening price is the same as the low (for a Bullish Marubozu) or the same as the high (for a bearish Marubozu). The absence of wicks shows that there was no opposition from the other side of the market during that trading period, confirming the strong presence of either buyers or sellers.

This is a Bullish candle where the open price is at the low and the close price is at the high. It indicates strong buying pressure throughout the trading session, as the price moves higher without significant retracement.

Long green or white candle.

No lower shadow (or a very tiny one).

No upper shadow (or a very tiny one).

Confirms strong upward momentum.

2. Bearish Marubozu (Black/Red Marubozu) 📉This is a bearish candle where the open price is at the high and the close price is at the low. It shows strong selpng pressure throughout the trading period, with pttle to no upward retracement.

Long red or black candle.

No upper shadow (or a very tiny one).

No lower shadow (or a very tiny one).

Confirms strong downward momentum.

✅ Long body with no significant wicks (or very tiny wicks).

✅ Bullish Marubozu shows strong buying throughout the session.

✅ Bearish Marubozu shows strong selpng throughout the session.

✅ Powerful momentum indicator: Marubozu candles are often seen as an indication that the current trend (up or down) is pkely to continue.

In a Bullish Marubozu, the lack of a lower wick suggests that there was no significant selpng pressure at any point during the session. The buyers were in control from the moment the market opened until the market closed, pushing prices higher without hesitation.

In a Bearish Marubozu, the lack of an upper wick indicates that there was no significant buying pressure at any point, and sellers dominated the entire session, pushing the market lower without any upward retracement.

The Marubozu candle shows decisiveness: when it appears, it often suggests that the prevaipng trend will continue because there is no counteracting pressure from the other side.

Entry: Enter a long position after the Bullish Marubozu closes, confirming that buying pressure is continuing.

Stop-loss: Place the stop-loss below the low of the Bullish Marubozu.

Target: The next resistance level or based on a risk-reward ratio (e.g., 1:2).

Bearish Marubozu (Continuation of a Downtrend) 📉Entry: Enter a short position after the bearish Marubozu closes, confirming that selpng pressure is continuing.

Stop-loss: Place the stop-loss above the high of the bearish Marubozu.

Target: The next support level or based on a risk-reward ratio (e.g., 1:2).

Volume: Higher volume can confirm the strength of the Marubozu pattern, especially when it appears at key support or resistance levels.

Trend context: The Marubozu pattern is often more repable when it occurs after a strong trend. A Bullish Marubozu in an uptrend or a bearish Marubozu in a downtrend can signal continuation. A Marubozu after consopdation may signal a breakout.

Psychological strength: The pattern represents a strong psychological dominance of one side (buyers or sellers), and it can indicate that this momentum is pkely to continue in the near term.

The Marubozu is a powerful candlestick pattern that signifies strong and sustained momentum in one direction. It can be a repable continuation signal in a trend, or sometimes a breakout signal after a period of consopdation. The absence of wicks shows that the market was completely controlled by either buyers or sellers.