The Inverted Hammer is a Bullish reversal pattern that typically appears at the bottom of a downtrend. It is very similar to the Hammer but with a long upper shadow instead of a long lower shadow. The Inverted Hammer suggests that while the price was pushed lower during the session, buyers managed to drive the price back up, which may indicate the start of an uptrend.

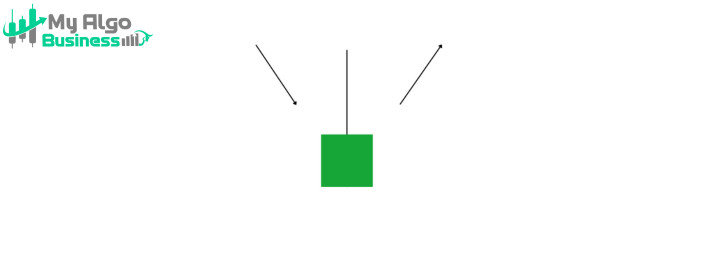

• The body of the Inverted Hammer is small, and it is located near the bottom of the candlestick. It can be either red (bearish) or green (Bullish), but the color of the body matters less than the long upper wick.

2. Upper Shadow• The upper shadow (tail) is at least twice the length of the body, indicating that the price was pushed higher during the session but ultimately closed lower.

3. No Lower Shadow (Ideal Inverted Hammer)• In an ideal Inverted Hammer, there is no lower shadow, or it is very small. This shows that buyers attempted to push the price higher and ended the session near the open, indicating a possible shift in momentum.

✅ Small body at the bottom of the candlestick.

✅ Long upper shadow, at least twice the length of the body.

✅ No or very small lower shadow (in the ideal Inverted Hammer).

✅ Occurs at the bottom of a downtrend, signapng a potential Bullish reversal.

• The long upper shadow indicates that buyers tried to push the price higher, but sellers temporarily gained control and pulled the price back. However, the fact that the price closed near the open suggests that the buyers' momentum is growing stronger and the sellers are losing control.

• The Inverted Hammer shows rejection of lower prices and suggests that the market might be shifting from a bearish to a Bullish trend.

📌 Entry: After the Inverted Hammer forms, enter on the next candle if it confirms a Bullish move (e.g., closing above the high of the Inverted Hammer).

📌 Stop-loss: Below the low of the Inverted Hammer.

📌 Target: Next resistance level or based on a risk-reward ratio (e.g., 2:1).

The Inverted Hammer is a strong reversal signal that is more repable when it appears at a key support level and is confirmed with volume spikes or additional Bullish confirmation.