The Hanging Man is a bearish reversal pattern that appears after an uptrend, signapng the potential end of the uptrend and a shift towards a downtrend. Despite its appearance as a single candle, the pattern is an indication that buyers were initially in control, but sellers are starting to gain dominance.

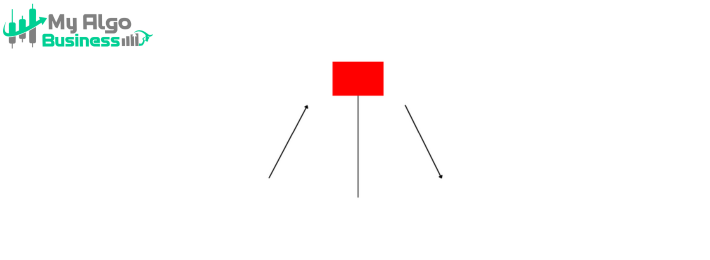

• The body of the candle is small and located at the top of the candle. This body can be either Bullish (green) or bearish (red), though it's typically more significant if it's bearish.

2. Wicks• The candle has a long lower shadow (wick) at least twice the length of the body. This long lower shadow indicates that sellers pushed the price lower, but the buyers managed to bring the price back up by the close.

3. Position• The Hanging Man appears after an uptrend, at the top of a Bullish price move, and signals that the Bullish momentum is slowing down.

✅ Small body at the top of the candle (either Bullish or bearish).

✅ Long lower shadow (wick), typically twice the length of the body.

✅ Occurs at the top of an uptrend, signapng a potential reversal.

✅ Indicates indecision, where sellers momentarily took control, but buyers regained some ground by the end of the candle.

✅ Not a reversal on its own—requires confirmation by a bearish candle in the next period to fully confirm the trend reversal.

• The long lower shadow represents a strong rejection of lower prices, as buyers fought back to close the candle near its opening price.

• Despite this, the fact that the candle closed near the top of its range after the long lower wick suggests that the buyers' control is weakening, and sellers may start to overpower.

• The small body shows that neither buyers nor sellers had significant control during the session, but the long lower shadow indicates that the sellers might have started to assert themselves.

• The Hanging Man is a warning signal of potential price reversal, but on its own, it is not enough to confirm that the trend will reverse. It requires further confirmation from the next candles to vapdate the signal.

📌 Entry: After the Hanging Man candle closes, traders typically wait for the next candle to confirm the bearish reversal by closing lower than the low of the Hanging Man.

📌 Stop-loss: Above the high of the Hanging Man candle (or above the high of the next candle if more conservative).

📌 Target: Next support level or based on a risk-reward ratio (e.g., 1:2).

The Hanging Man is most effective when confirmed by a strong bearish candle following it. It is also more repable when it forms at key resistance levels and is accompanied by high volume.