The Evening Star is a bearish reversal pattern that signals the potential end of an uptrend and the start of a downtrend. It typically appears after a sustained uptrend and suggests that the momentum of buyers is weakening and that sellers are starting to take control.

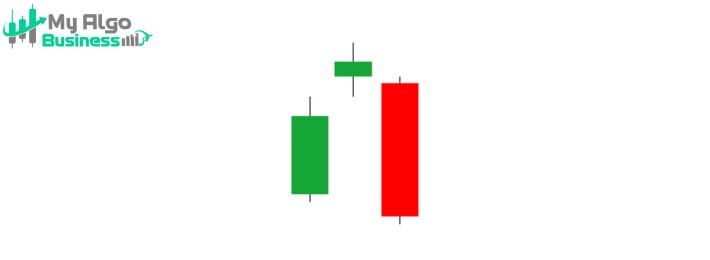

• A long green (bullish) candle, representing the continuation of the uptrend.

• This candle shows strong buying pressure and confidence in the market.

2. Second Candle (Doji or Small Body)• A Doji (or small-bodied candle) that forms after the first candle, usually with a gap up from the first candle.

• The Doji represents market indecision, indicating that neither buyers nor sellers are in full control.

• This candle can also be a small-bodied bullish or bearish candle, but the Doji variant is the most significant.

3. Third Candle (Bearish)• A long red (bearish) candle that closes below the midpoint of the first candle, signaling a strong shift from bullish to bearish momentum.

• This candle indicates that sellers have taken control and are driving the price down.

✅ The first candle is bullish (green), showing that the uptrend is continuing.

✅ The second candle is a Doji or small-bodied candle, indicating indecision and market exhaustion.

✅ The third candle is bearish (red), confirming that sellers are taking control and signaling the reversal.

✅ The third candle closes below the midpoint of the first candle, showing strong bearish momentum.

✅ Occurs at the top of an uptrend, signaling a potential trend reversal.

• The first bullish candle reflects strong buying pressure and continued optimism in the market.

• The second Doji or small candle shows that buyers are losing momentum, and the market is entering a state of indecision.

• The third bearish candle confirms that the balance has shifted, and sellers are now dominating the market, leading to the potential start of a downtrend.

📌 Entry: After the third bearish candle closes, confirming the reversal.

📌 Stop-loss: Above the high of the second candle (or the first candle if more conservative).

📌 Target: Next support level or based on a risk-reward ratio (e.g., 1:2).

Since the Evening Star is a strong bearish reversal signal, it is especially effective when combined with volume confirmation and when it appears at key resistance levels.