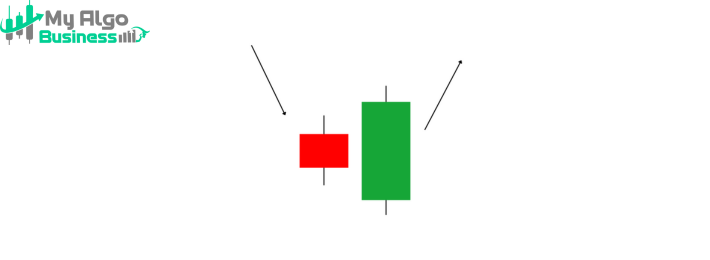

The Bullish Engulfing is a strong bullish reversal pattern that signals a shift from a downtrend to an uptrend. It consists of two candles and is commonly seen at the bottom of a downtrend.

• A red (bearish) candle, indicating continued selling pressure.

2. Second Candle (Bullish and Engulfing):• A green (bullish) candle that completely engulfs the body of the first candle (its open is lower, and its close is higher than the previous candle’s range).

• The bigger the second candle, the stronger the reversal signal.

✅ The second candle must fully engulf the first candle’s body (not necessarily the wicks).

✅ Appears at the bottom of a downtrend and signals a reversal.

✅ Stronger if the second candle has high volume and closes near its high.

• The first bearish candle shows that sellers are in control.

• The second bullish candle completely overpowers the selling pressure, signaling a momentum shift.

• This pattern attracts more buyers, often leading to further price increases.

📌 Entry: After the second (bullish) candle closes above the first candle.

📌 Stop-loss: Below the low of the second candle.

📌 Target: Next resistance level or based on a risk-reward ratio (e.g., 1:2).

Since the Bullish Engulfing pattern is a strong reversal signal, it is often used with volume confirmation and support levels for better accuracy.