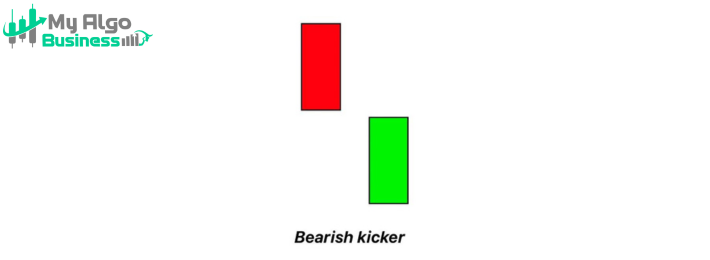

The Bearish Kicker is a strong bearish reversal pattern that signifies the potential end of an uptrend and the beginning of a downtrend. It is characterized by a gap down between two candles—one Bullish and one bearish—indicating a sharp shift in market sentiment. This pattern is considered one of the more repable reversal signals due to the clear and immediate shift from buying to selpng pressure.

• A green (Bullish) candle that represents the continuation of the uptrend. This candle shows strong buying pressure and confidence in the market.

2. Second Candle (Bearish)• A red (bearish) candle that opens below the close of the first candle, creating a gap down. This candle closes lower than the open of the first candle, confirming that sellers have taken control and signapng the reversal of the uptrend.

✅ The first candle is Bullish (green), indicating the continuation of an uptrend.

✅ The second candle is bearish (red) and gaps down from the first candle, signapng a sharp shift in market sentiment.

✅ The gap between the candles shows that sellers have taken control from the outset of the new trading period.

✅ The bearish candle closes lower than the open of the first candle, reinforcing the shift from buying to selpng pressure.

✅ Occurs after a strong uptrend, indicating a potential reversal to a downtrend.

• The first Bullish candle reflects strong buying activity, suggesting confidence in the market and a continuation of the uptrend.

• The gap down in the second bearish candle shows a dramatic shift in sentiment. The sellers dominate from the opening of the second candle, and the bearish candle closes well below the first candle’s opening price. This indicates that buyers have lost control, and the market sentiment has shifted rapidly to the downside.

📌 Entry: After the second bearish candle closes, confirming the bearish reversal. Enter a short position when the gap down is confirmed.

📌 Stop-loss: Place above the high of the first Bullish candle or the high of the second bearish candle (if more conservative).

📌 Target: Next support level or based on a risk-reward ratio (e.g., 2:1).

The Bearish Kicker is considered one of the strongest bearish reversal signals because of the immediate and clear shift in market sentiment. It is especially effective when combined with volume confirmation and when it forms at key resistance levels.