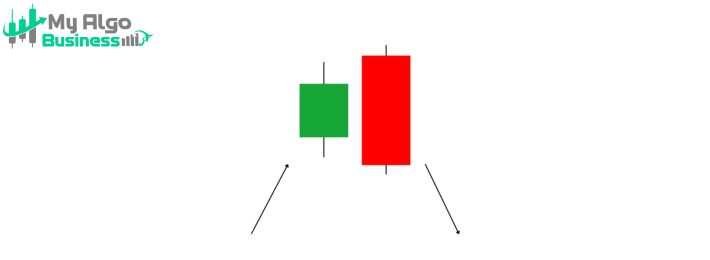

The Bearish Engulfing is a strong bearish reversal pattern that signals a potential change in trend from bullish to bearish. It consists of two candles, with the second candle completely engulfing the first candle's body, indicating that the bears have taken control.

• A green (bullish) candle that represents a strong uptrend or upward momentum.

• This candle closes higher, showing that buyers are in control.

• A red (bearish) candle that engulfs the body of the first candle completely (the open and close of the second candle are outside the range of the first).

• The second candle opens higher than the first candle’s close and closes lower than the first candle’s open, showing that the sellers have overwhelmed the buyers.

✅ The second candle must completely engulf the body of the first candle.

✅ The first candle is bullish (green), and the second candle is bearish (red).

✅ Appears at the top of an uptrend, signaling a potential trend reversal.

✅ The bearish engulfing candle should be of significant size, ideally larger than the first candle.

• The first bullish candle indicates that buyers are in control and the price is rising.

• The second bearish candle engulfs the first one, showing that sellers have overtaken the market and are pushing the price lower, signaling a potential reversal or trend change.

• The complete engulfing of the first candle by the second is a powerful indication of a shift in momentum from bulls to bears.

📌 Entry: After the second bearish candle closes below the first candle's low, confirming the reversal.

📌 Stop-loss: Above the high of the first candle or the second candle (depending on risk tolerance).

📌 Target: Next resistance level or based on a risk-reward ratio (e.g., 1:2).

The Bearish Engulfing is a strong reversal pattern and is more effective when confirmed by high volume and appears at key resistance levels.