The Bearish Abandoned Baby is a rare but powerful bearish reversal pattern that signals a potential trend change from Bullish to bearish. It typically appears at the top of an uptrend and is characterized by three distinct candles: a Bullish candle, a Doji that gaps up, and a bearish candle that gaps down, creating a gap between the candles.

This pattern indicates that buyers' momentum is exhausted, and sellers have gained control, making it a strong signal of a possible trend reversal.

• A long green (Bullish) candle that indicates the continuation of an uptrend.

• This candle represents strong buying pressure.

• A Doji candle (small body with long shadows) that gaps up from the first candle, meaning the opening price of the Doji is higher than the closing price of the first candle.

• The Doji represents market indecision, where neither buyers nor sellers are fully in control, but it also signals that the buying momentum is slowing.

• A long red (bearish) candle that gaps down from the Doji, meaning the opening price of the bearish candle is lower than the closing price of the Doji.

• This candle confirms that sellers have taken control and are pushing the price lower, signapng the potential start of a downtrend.

✅ The first candle is Bullish (green), indicating the continuation of the uptrend.

✅ The second candle is a Doji, which gaps up from the first candle, reflecting indecision and loss of buying momentum.

✅ The third candle is bearish (red), which gaps down from the Doji and confirms the bearish reversal.

✅ Appears at the top of an uptrend, signapng a potential reversal from Bullish to bearish.

✅ The gap up and gap down between the candles creates a distinct separation that makes the pattern more significant.

• The first Bullish candle shows that buyers were in control, continuing the uptrend.

• The Doji in the second position shows market indecision, with neither buyers nor sellers taking full control, signapng a slowdown in momentum.

• The third bearish candle confirms that sellers have taken over and that the market has reversed direction, pushing the price lower.

• The gaps between the candles are particularly important, as they show the abandonment of the previous trend, and the Doji in the middle suggests market hesitation before the sellers take control in the final candle.

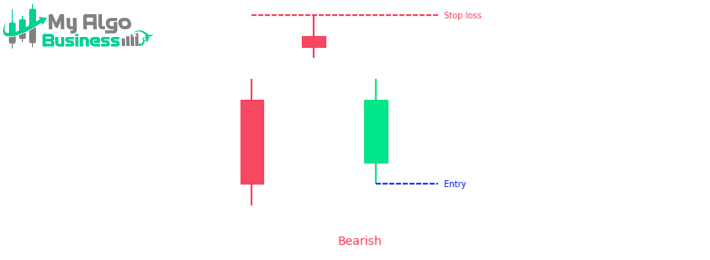

📌 Entry: After the third bearish candle closes below the second candle’s low, confirming the trend reversal.

📌 Stop-loss: Above the high of the second candle (Doji) or the first candle.

📌 Target: Next support level or based on a risk-reward ratio (e.g., 1:2).

The Bearish Abandoned Baby is a strong reversal signal and is particularly effective when it appears at key resistance levels and is confirmed with volume.